Then independent central banks are the one institution in the economy that have the power to bail out besieged markets, failing banks, and battered global corporations, when the worst happens.

When markets crash, when financial meltdown threatens economies, at the horror of natural disaster, pandemic, or war, it is to the central banker the world turns to for refuge.

Where does that huge power come from? The answer is complex.

The power of the central bank is a mix: a combination. Central bank power comes from the backing of powerful governments such as the USA and the European Union; the recognition of its supreme ability to steward the economy by global institutions from the World Trade Organization to the UN; and wealthy international investors.

The power of the central bank is also the result of business and consumer confidence in the power of these banks to underwrite the global economy and marketplace. The preceding allows the central bank to print currency, even without limit.

Central banks prop up the global economic order. And the rule of the super wealthy – the 1% – is backed by the FED that will always intervene to safeguard the global financial order.

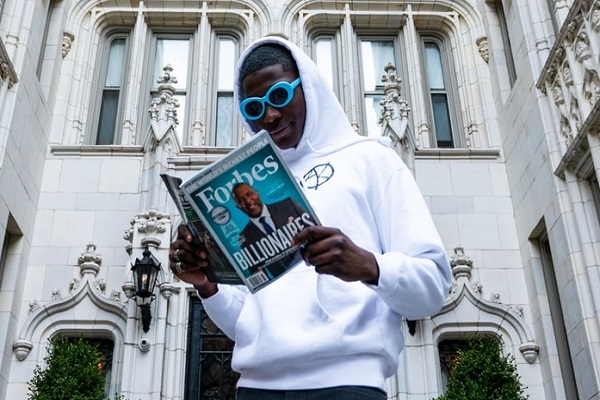

Some pundit referred to the central bank as the billionaire’s bank. Why? Billionaires and wealthy investors view the central bank as the bank of last resort and the safe place to migrate when there is economic, political, and natural disaster. Investors prefer the safety of government issued debt- bonds and associated instruments- in times of crisis.

Central banks are arguably more powerful than ruling politicians as history shows that central bankers are listened to by the establishment and society over and above any politician in time of crisis. This is a result of the confidence placed in central banking by ruling elites and society in general.

One great ally of the central bank in recent decades is low inflation.

Low inflation is one key reason why central banks have been able to pump stimulus cash into ailing economies without any fear of repercussion such as ruinous high inflation.

The reasons for low global inflation are not clear cut: frugal and cautious consumers post the 2008 financial meltdown; globalization and economies of scale; and the rise of China- the world’s factory.

Digitization has lowered business costs and that is also a lid on inflation, add greater competitiveness in economies.

The evidence shows that in spite of printing over $30 trillion since 2009, inflation remains subdued.

Consequently, there is no reason to pull back from Quantitative Easing- QE and bond buying- as the economic wrecking ball termed inflation is far from being a problem, especially in a deflationary environment.

If anything, a small rise in inflation is pointer to economic recovery.

A rise in inflation may well herald the much desired Post Covid economic recovery.

It is indeed a paradox central banks are hoping for some inflation as a tool to stimulate economies.

Inflationary concerns remain, and a massive sell off in global markets at the very end of February 2021 was a signal investors are worried about inflation and the sustainability of ongoing stimulus spending.

Investors are fearful of a bond market meltdown and inflation, but not central bankers.

Central banks have near unlimited power to print cash.

And in a low inflation environment that power will not diminish any time soon.

Connect with Dickson Igwe on Twitter and Facebook.