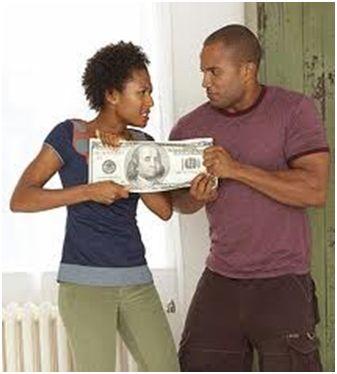

Navigating through a relationship is never easy. Other than the typical issues such as affection, romance, tolerating pet peeves, the touchy subject of money is one that has doomed many. It is best to be honest about money as financial deception can ruin a relationship. It is best to have transparency which creates trust and helps to build confidence in the relationship.

Navigating through a relationship is never easy. Other than the typical issues such as affection, romance, tolerating pet peeves, the touchy subject of money is one that has doomed many. It is best to be honest about money as financial deception can ruin a relationship. It is best to have transparency which creates trust and helps to build confidence in the relationship.

There are certain traits and perspectives to avoid so you don’t cheat financially on your spouse. Be honest with your income and expenditures. When it comes to what and how much one divulges about their finances to their partner. One main pitfall is keeping secrets, which generally falls to the woman who may hide the amount of money they make or spend, viewing the male as the breadwinner who should be responsible for the majority if not all household expenses. Before the men rejoice by agreeing with my point, there is the flip side to this trait which falls to the man who is the big spender who lavishes money on expensive gadgets, dinners with friends and expensive gifts on so called “friends” as your priorities lie to your home and you may need funds to handle unexpected household emergencies.

Typically, traditional males use their ability to sufficiently provide for the home as a measure of their success and manhood. However, it is not a cardinal sin to get help from your mate as it is a relationship and you need to be supportive of each other. If your partner makes more than you do, don’t just take it for granted that you should just spend as you see fit. It is best to discuss openly who will handle what financial responsibilities and ensure you are both comfortable with the view that whoever makes more should spend more.

Let your partner know where you stand financially. It is important to let your partner know if there are outstanding debts such as student loans, credit card debt, and lack of a pension plan, health or life insurance. More importantly is never to take on someone else’s debts; you assist with a strategy to help with paying off the debt or help to pay some yourself as this will help but never take on the entire debt on oneself as this will not teach your partner financial responsibility and set a precedence that you will always pick up the slack for their financial mishaps.

Finally, never blithely ignore your finances. Make sure you check together on savings and investments once a month to ensure you are both aware of what is happening. Doing this will ensure you know that your accounts balance, what is your net worth, what is the status of your nest egg and that it is virtually untouched. Financial deception is just as damaging to a relationship as cheating so it is important to avoid that pitfall as well.