Caribbean rum is facing worrying challenges and risks severe losses in export markets. CaribDirect.com is carrying a series of articles that explore what the region is up against and considers how this valuable trade can be safeguarded. This second article in the series will look at the problem in America.

Puerto Rico and the US Virgin Islands (USVI) provide funding and extensive tax breaks to rum distillers in their territories. CARICOM is most agitated claiming that the support gives giant companies like Diageo that operate there, a massive and unfair advantage.

At times talking tough and at other times being conciliatory, Caribbean governments have been objecting to the arrangements. So far their efforts have met with no success whatsoever.

Cariforum ambassadors in Washington wrote to US Trade Representative Ron Kirk on the 9 August 2012, while on 24 August, Kenny Anthony, then chairman of CARICOM, wrote to Barack Obama.

In May of this year, the Council for Trade and Economic Development (COTED) stated that it is determined “to seek a satisfactory solution to the matter of trade-distorting subsidies being granted to USVI and Puerto Rico rum producers that threaten the long-term viability of the rum industry in the Caribbean”.

But what is the subsidy programme all about and how does it work?

No Level Playing Field

Rum distillers in Puerto Rico and the USVI receive a range of grants for marketing, promotion, subsidising their raw material purchases like molasses, building new facilities etc. as well as exemptions from various property and other taxes.

This reduces their costs of production and enables them to get their rum onto the shelf at lower cost than would otherwise have been the case.

Caribbean rum exporters argue that this not only disadvantages them vis-à-vis their Puerto Rican and USVI competitors, but that the arrangement is illegal under WTO rules. John Beale, Barbados’ ambassador to the US, told the Washington Diplomat in January, “We have had four legal opinions, and … the WTO would probably rule in our favour.”

Where does the money come from?

The US federal government levies an excise tax of $13.50 per proof-gallon on rum and, under what they call the Cover Over programme and passes the proceeds to the treasuries of Puerto Rico and the USVI, which uses some of the money to fund the subsidies.

The arrangement dates back to the Jones Act of 1917, which directed that the tax on all rum produced in or imported into the US would be passed on to the Puerto Rico Treasury. Quite bizarrely, that same legislation also prohibited the production and sale of alcohol!

The arrangement was extended in 1954 to the USVI.

A considerable amount of money is involved; in 2008 Puerto Rico received US$371m and the USVI almost US$100m. Quite understandably, these territories staunchly defend the lucrative facility, which has to be renewed every year by Congress.

While the programme is financed from a levy on rum, funds do not have to be spent just in that sector. Its purpose is quite broad. The 1954 Senate report accompanying the Act expected “the covered-over revenue to loosen the dependence of the USVI on periodic appropriations from the U.S. government” and called for “stimulating and increasing business in every way possible”.

The Cover Over programme is really a redistribution of tax revenue to support development in two relatively economically disadvantaged territories of the US.

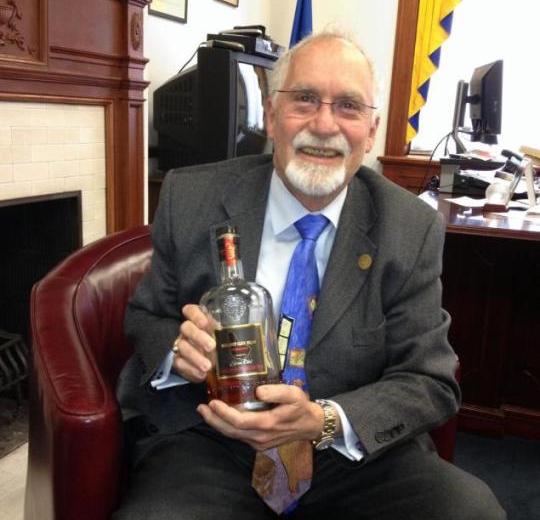

Dr Frank Ward, chairman, West Indies Rum and Spirits Producers Association. Photo courtesy jamaica-gleaner.com

Frank Ward, chairman of the West Indies Rum and Spirits Producers’ Association (WIRSPA), told the Washington Diplomat magazine last January: “Our beef is really with the subsidies given to the rum companies, not with the programme itself.

Some of our member companies have already seen massive losses because of their inability to compete on price.”

Whilst the Caribbean does not oppose the Cover Over payments, if the subsidies that it finances are causing as much harm as WIRSPA claims, then the region’s agitation is understandable.

The next article in this series will examine another challenge facing Caribbean rum exporters, this time in Europe, that could well turn out to have even more serious long-term implications for their future viability than the US subsidies…